What to Look for When Investing in Residential Property

Investing in residential real estate remains one of the most reliable ways to build long-term wealth. But not all properties are created equal—and making the right investment requires more than just a good location. Whether you're a first-time investor or adding to your portfolio, here are the key factors to consider when evaluating a residential property.

1. Location Is Still King

The golden rule of real estate holds true: location matters most. A desirable location means better appreciation over time, higher rental income, and lower vacancy rates. Look for areas with:

Even within a good city, micro-locations can vary—so pay attention to street-level details like noise, views, and sunlight.

2. Property Condition and Build Quality

Inspecting the physical condition of the home is essential. Hidden maintenance issues can turn a profitable investment into a money drain. Consider:

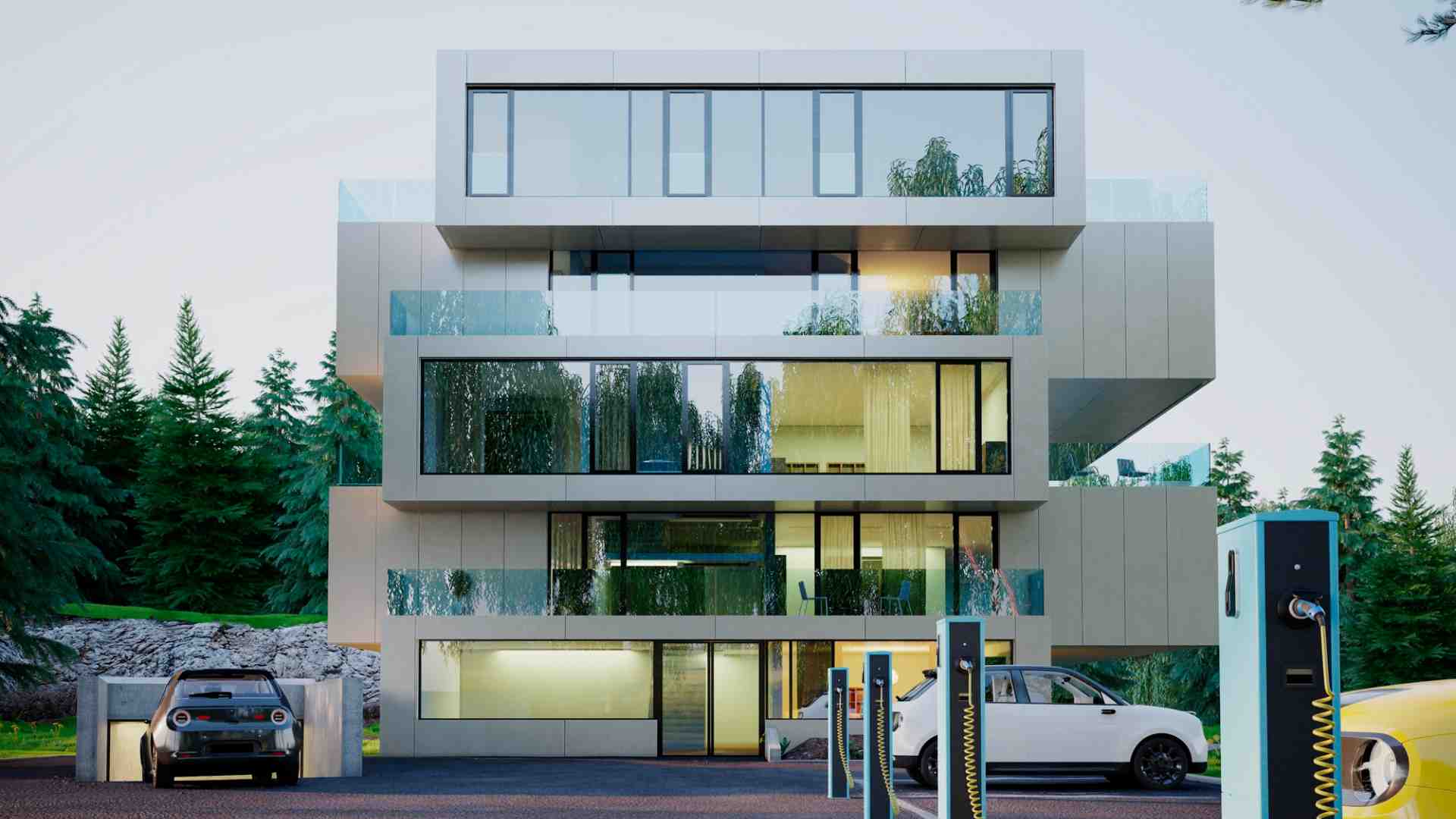

3. developer reputation

If you're investing in a newly built or off-plan property, the credibility of the developer is critical. Choose builders known for quality, transparency, and timely delivery like Structura.

Research their previous projects, read reviews, and if possible, visit completed developments to assess construction quality and post-sale support.

Investing in residential property is as much about strategy as it is about structure. With careful planning, market knowledge, and the right property, you can secure not just returns—but long-term financial security.